London vouchers 2014

The main part of this note refers to Employees joining a Childcare Voucher scheme on or after 6th April 2011.

The main part of this note refers to Employees joining a Childcare Voucher scheme on or after 6th April 2011.

The rates and limits refer to the Tax Year ending 5th April 2014, and it is assumed that the vouchers had been supplied for qualifying childcare.

Why?

As an employer, you are required to establish the maximum amount of Income Tax and National Insurance-free Childcare Vouchers you can give to each employee in the scheme, based on their income for the current Tax Year to 5th April 2014.

If vouchers are provided at a level above the limits, the excess should be reported on form P11D for the year, and Class 1 Employee’s and Employer’s National Insurance Contributions deducted and paid via the payroll at the time the excess vouchers are made available to the employee.

Where do I file it?

There is no requirement to file this with HMRC, but you must keep a copy of the assessment on file (paper or electronic), as HMRC would look for it during a PAYE Investigation.

Is it Important?

Yes, the tax and National Insurance-free nature of the payments made within the appropriate limits depends on the employer having carried out a Basic Earnings Assessment.

Without it, the full value of the vouchers supplied would be treated as a benefit subject to Income tax and National Insurance Contributions.

How often?

Being necessarily an estimate of the employees’ earnings for the coming year, you should repeat the exercise if earnings etc change radically, but at a minimum, the assessment must be carried out at least once, and preferably at the start of, each Tax Year.

How?

Include:

- Basic pay as stated in the employee’s contract of employment (If a Salary Sacrifice is in place, please use the reduced, post-Sacrifice amount).

- Contractual or guaranteed bonuses

- Contractual Commission

- London weighting or other similar regional allowances

- Guaranteed overtime payments

- Taxable benefits

- Cash equivalent of any taxable benefits (eg company car benefit)

- Shift allowances

- Skills allowance

- Retention and recruitment allowances

- Market rate supplements

= A

Then deduct the following items from A:

- The employee’s Personal Allowance (For Year Ending 5th April 2014, £9, 440)*

- Performance related or discretionary bonuses

- Overtime payments

- Contributions to occupational pension schemes

- Payroll giving donations

- Removal expenses

- Expenses payments

= B

* nb If an employee earns more than £150, 000, do not make the £9, 440 reduction for Personal Allowances

Based on the Assessed figure “B” above, the maximum amounts of Tax and NIC-free Childcare Vouchers an employee may receive are, :

| Maximum: | |||

| Income Range | Per Week | Per Month | Per Year |

| £0 to £41, 450 | £55 | £243 | £2915 |

| £41, 451 to £150, 000 | £28 | £124 | £1484 |

| Over £150.000 | £25 | £110 | £1325 |

There is no need to carry out an Assessment for existing members of schemes who were already participating on or before 6 April 2011.

The usual annual renewal of voucher arrangements does not affect this. The crucial date is when the employee initially joined the scheme.

The pre-existing limits for the amount of Childcare Vouchers that can be given to employees and attract Tax and National Insurance relief continue to apply as below.

| Maximum: |

| Per Week |

| Per Month |

| Per Year |

If vouchers are provided at a level above these limits, the excess should be reported on form P11D for the year, and Class 1 Employee’s and Employer’s National Insurance Contributions deducted and paid via the payroll at the time the excess vouchers are made available to the employee.

skiplagged flights flights to cabo san lucas cheapest flights right now cheap flights to las vegas jetblue flights check in alaska flights flights from lax to cancun frontier airlines flights cheap tickets flights flights to austin www.travelocity.com flights san juan flights cheap flights from chicago flights from charlotte cheap flights from msp flights to montana minneapolis flights american airlines canceling flights flights to tokyo cheap last minute flights flights from chicago to atlanta flights to detroit cheap airline flights flights from atlanta to las vegas flights to germany houston to dallas flights jet blue flights flights from tampa dubai flights flights to utah bahamas flights flights to va lax flights flights to pittsburgh flights to thailand india to usa flights flights to cabo boston flights flights to houston texas flights from las vegas air canada flights status flights to us virgin islands flights to miami from lax flights from boston to miami multi city flights best day to book flights flights from chicago to miami flights to new york city flights cheap one way flights flights from dallas to cancun cheap flights from houston flights to phoenix arizona flights to amsterdam flights from lax to nyc flights from atlanta to dallas flights to denver colorado round trip flights flights to tulum flights to oregon domestic flights flights to columbus ohio flights to spain avianca flights flights cancelled today costa rica flights flights from chicago to phoenix booking.com flightsShare this Post

Related posts

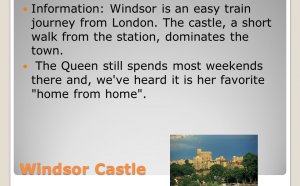

Windsor Castle information

Perhaps the most famous castle in the World, Windsor Castle is home to Her Majesty Queen Elizabeth II and is undoubtedly…

Read MoreTower tickets

Tower of Tickets Fun for all ages, this 100% skill-based, 4-player game is simple to play. Players push the button to engage…

Read More